Paytm makes money through commissions, financial services, lending, merchant transactions, Paytm Payments Bank, advertising, and wealth management products. It follows a multi-sided platform model, connecting users, merchants, and financial institutions to build India’s largest digital finance ecosystem.

If you’ve ever used Paytm for a ₹10 recharge or scanned a QR code at your local store, you might’ve wondered how does Paytm earn from all this when most of it looks free?

The truth is, Paytm’s business model isn’t about charging you directly. It’s about building an entire ecosystem around payments, banking, and financial services and earning from those layers.

In this article, I’ll break down exactly how Paytm’s business model works, how it makes money, and where it’s heading next in India’s fintech revolution.

What is Paytm?

Paytm (short for “Pay Through Mobile”) is a leading Indian fintech company founded in 2010 by Vijay Shekhar Sharma under One97 Communications Ltd. It started as a mobile recharge and bill payment platform but quickly evolved into a complete digital financial ecosystem.

Today, Paytm operates in:

- Digital payments (Wallet, UPI, QR code, POS)

- Financial services (Banking, lending, insurance)

- Commerce and cloud services (Ticketing, Mall, ads)

- Wealth management (Paytm Money)

With over 300 million users and 20 million merchants, Paytm has become one of the most used fintech apps in India.

Paytm Business Model Overview

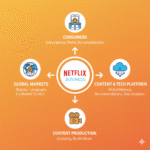

Paytm follows a multi-sided platform model that connects users, merchants, and financial partners.

It’s built around three main pillars:

- Payments Ecosystem – Free transactions attract users.

- Financial Ecosystem – Offers banking, loans, and investments.

- Commerce & Cloud Services – Generates fees from merchants and brands.

This combination allows Paytm to earn from multiple sources while offering free services to consumers a smart “ecosystem play” that keeps users inside its platform.

1. Commissions from Recharge and Bill Payments

When Paytm first started in 2010, its major revenue came from mobile recharges and utility bill payments.

- Every time a user recharged a mobile phone, DTH, or paid an electricity bill through Paytm, the platform earned a small commission from telecom operators or service providers.

- For example, if you pay your ₹1,000 electricity bill via Paytm, a few rupees from that transaction go to Paytm as commission.

Though this segment’s contribution has reduced over the years due to UPI and diversification, it still remains one of Paytm’s steady and foundational income sources — especially in Tier 2 and Tier 3 cities, where mobile recharges and utility payments dominate user activity.

2. Merchant Payments and Transaction Fees

One of Paytm’s biggest growth drivers today is its merchant payment ecosystem.

- Paytm provides QR codes, soundboxes, and POS machines to over 30 million merchants across India.

- While UPI payments are free for customers, merchants pay Paytm small transaction fees or device rentals for advanced settlement features, data analytics, and faster fund transfers.

These include:

- MDR (Merchant Discount Rate) on non-UPI payments

- Monthly rentals for smart POS or soundboxes

- Premium settlement services (like instant settlements)

This segment is the backbone of Paytm’s payment revenue, as it earns both recurring and usage-based income from millions of businesses — from local kirana stores to large retail chains.

3. Paytm Payments Bank

Launched in 2017, Paytm Payments Bank (PPBL) is a key part of the ecosystem.

It makes money through:

- Interest Spread: The difference between interest earned from lending and the interest paid on customer deposits.

- FASTag Fees: Issuing and managing FASTags for toll payments generates commissions.

- Debit Cards and Account Services: Paytm charges for physical debit cards, account maintenance, and certain transactions.

Although the RBI recently restricted some parts of PPBL’s operations (like accepting new deposits), it remains an essential revenue contributor and helps Paytm retain users within its ecosystem, encouraging them to transact, save, and spend within the same platform.

4. Lending and Credit Services

This is one of Paytm’s fastest-growing segments.

Through partnerships with NBFCs (Non-Banking Financial Companies), Paytm offers:

- Buy Now Pay Later (BNPL) products

- Merchant loans for small businesses

- Personal loans for consumers

Here’s how Paytm earns:

- Commission from lending partners when a loan is approved

- Interest margin on loans disbursed

- Processing and late payment fees

This segment aligns with Paytm’s long-term goal — to build a fintech-led digital lending ecosystem, targeting both consumers and small business owners who already use Paytm for payments.

5. Paytm Money (Wealth Management)

Paytm Money is Paytm’s investment and trading arm.

It earns revenue from:

- Brokerage fees on stock trading

- Transaction charges on mutual fund and IPO investments

- Distribution commissions from fund houses

The idea here is to create a sticky user base — people who invest or trade using Paytm Money are more likely to remain in the Paytm ecosystem for other services too (like payments, loans, or insurance).

Paytm Money has positioned itself as an affordable, beginner-friendly investing platform, helping Paytm expand beyond payments and build trust among financially active users.

6. Insurance and Financial Products

Paytm also acts as an insurance marketplace.

Through its app, users can buy policies across:

- Health insurance

- Motor insurance

- Life insurance

Paytm earns a commission for each policy sold, working as an intermediary between users and insurance companies.

This not only diversifies revenue but also positions Paytm as a one-stop financial app, allowing users to manage payments, savings, and protection in one place.

7. Commerce and Cloud Services

Paytm’s ecosystem goes beyond fintech — it also earns from commerce and cloud-based services.

a) Commerce:

- Paytm sells tickets for movies, trains, buses, and flights.

- It previously ran Paytm Mall, an e-commerce venture, which now contributes through select partnerships.

- Each ticket sale brings in a commission or service fee.

b) Cloud and Business Services:

Paytm provides payment gateways, data analytics, and cloud-based business tools to merchants.

- These tools help small businesses manage payments, track performance, and even run targeted promotions.

- Paytm earns from subscriptions, API fees, and advertising partnerships within this segment.

Together, these form an important B2B revenue line, leveraging Paytm’s massive merchant network.

8. Advertising Revenue

Like Google and Facebook, Paytm has built its own ad ecosystem within its app.

- Brands can place sponsored banners, app tiles, or offers on Paytm’s home screen, transaction pages, or merchant dashboards.

- These ads are targeted based on user behavior, giving brands higher conversion rates.

For Paytm, this is a high-margin revenue source, since it already owns a large active user base (over 300 million). The advertising arm turns Paytm into a mini digital marketing platform, where brands pay for visibility.

9. Interest on User Balances

Lastly, Paytm Payments Bank earns from the interest generated on idle balances — the money users leave in their wallets or accounts.

Like traditional banks, Paytm earns interest by parking user deposits in approved instruments and government securities.

Even if individual balances are small, the aggregate volume makes this a reliable, consistent income stream.

Paytm Revenue Breakdown (FY2024 Snapshot)

While figures change yearly, Paytm’s revenue mix typically looks like this:

| Segment | Approx. Share |

|---|---|

| Payments and Financial Services | ~60% |

| Commerce and Cloud | ~25% |

| Marketing and Other Income | ~15% |

This diversification helps Paytm remain stable even as certain categories fluctuate (like UPI margins).

Type of Business Model Paytm Follows

Paytm’s overall structure combines several models:

| Model Type | Description |

|---|---|

| Freemium | Offers free payments to attract users, monetizes via advanced features and services. |

| Aggregator | Connects multiple service providers with end-users. |

| Ecosystem Model | Creates value by linking payments, banking, and commerce under one platform. |

This approach helps Paytm scale rapidly while building long-term user retention.

Growth Strategy: What Keeps Paytm Expanding

Paytm’s growth isn’t about adding new users it’s about deepening monetization.

Its current strategy focuses on:

- Expanding lending and merchant financial services.

- Integrating credit and investment features into the Paytm app.

- Partnering with banks and NBFCs for scalable lending.

- Increasing merchant payment adoption through QR and POS systems.

Challenges Paytm Faces

Even with strong brand recall, Paytm faces several hurdles:

- Regulatory challenges (RBI restrictions on its bank).

- High competition from Google Pay, PhonePe, and Amazon Pay.

- Low profit margins due to free payment services.

- High customer acquisition costs for financial products.

These factors make profitability its biggest long-term challenge.

Future of Paytm: Where It’s Heading

The future of Paytm lies in becoming a full-fledged digital finance platform.

It’s already moving beyond payments into credit, insurance, wealth, and commerce.

If Paytm manages regulatory compliance and cost control, it can become India’s leading super financial app, serving both consumers and small businesses.

Conclusion

Paytm’s business model is built on ecosystem thinking attract users with free payments, then monetize through financial and merchant services.

From small commissions on recharges to large-scale lending and investments, Paytm has evolved into one of India’s most diverse fintech businesses.

Its next big challenge? Turning that scale into sustained profits.

FAQs

Paytm aims to become profitable by diversifying beyond digital payments. Its core profitability drivers include merchant commissions, financial services like Paytm Money and Paytm Insurance, lending partnerships through Paytm Finance, and device subscriptions (like Soundbox and POS machines). The company is reducing customer cashback expenses and focusing more on high-margin services such as loans and wealth management. As of recent quarters, Paytm’s losses have narrowed significantly, indicating a path toward sustained profitability through ecosystem monetization.

Paytm operates as both B2C (Business to Consumer) and B2B (Business to Business):

B2C: Offers mobile recharges, bill payments, UPI transfers, ticket booking, insurance, and investments to individual users.

B2B: Provides payment gateways, QR and Soundbox devices, and credit solutions for merchants.

This hybrid model allows Paytm to capture value from both ends of the transaction chain—users and merchants—making it a versatile fintech platform.

As of the latest financial reports, Paytm is still not consistently profitable, though it has significantly reduced its losses. The company’s revenue continues to grow, driven by payment services, merchant subscriptions, and lending. Paytm’s management expects operational profitability soon as it scales lending, insurance, and investment products while maintaining cost discipline.

The Unified Payments Interface (UPI) operates on a zero-charge model for consumers, meaning users can send and receive money instantly without transaction fees. However, the ecosystem generates value in indirect ways:

Banks and PSPs (Payment Service Providers) benefit from increased user engagement and cross-selling financial products.

Apps like Paytm, PhonePe, and Google Pay earn through merchant onboarding, data analytics, and financial partnerships.

The NPCI maintains UPI infrastructure and earns through system management fees.

In essence, UPI’s model focuses on growing digital adoption, while fintech players monetize through complementary services built around it.